Every heard of real estate crowdfunding and don't know where to start? We have you covered in our thorough guide to finding the best crowdfunding options.

When investing in real estate, there used to be one absolute truth: if you’re lacking in capital, you’re instantly out of the game. The players in this field are mainly high ballers – high net worth investors or investors with hundreds of millions.

If you’re not an accredited investor and have limited connections of your own, there’s simply no place for you in the real estate investment scene.

Enter real estate crowdfunding.

Thanks to the passage of the 2012 JOBS Act, even average investors can work together to pool their financial and intellectual resources for investing in big properties –properties they wouldn’t have been able to afford on their own.

The real estate crowdfunding space is constantly growing, and companies like Fundrise have enabled even non-accredited investors to participate in this thriving practice.

If you're just starting, it's easy to get overwhelmed by the number of options in the market.

I was all over real estate crowdfunding.

Personally, I'm more income-driven than other people. I like to find ways to continually increase my income.

Why? I believe that you can always cut your expenses.

The hard work is building reliable passive income, which is why I track the multiple forms of income with Personal Capital, a completely free way to link your cash flow, income and net worth.

The net worth tracker of Personal Capital has helped me grow my net worth from negative $60,000 to over $500,000.

There are hundreds of platforms all fighting for their share of investors. So who do you trust with your money and which company will help it grow the fastest?

To help you in your search for the best real estate crowdfunding platforms, we’ve shortlisted the best portals that are easy to use, propose clear goals, have a solid list of closed and active listings, and a unique niche.

Know that some of these websites only allow accredited investors to participate, but we’ve also thrown in a handful of platforms that allow real estate crowdfunding for non-accredited investors.

Table of Contents

What is Real Estate Crowdfunding?

In a nutshell, real estate crowdfunding is a way to invest in properties using small amounts of capital from several individuals. This is mostly done through crowdfunding platforms that bring together sponsors and investors.

Real estate crowdfunding requires two parties: the sponsor and a group of investors. The sponsor scouts out the property and raises the funds needed for acquiring and managing its daily operations.

The investors, on the other hand, provide most of the financial equity needed (the investors usually put in around 80-95% of the financial equity required, while the sponsor shells out around 5-20%).

The sponsor then distributes the profits among the investors on a monthly or quarterly schedule, depending on the agreement. Since properties usually appreciate over a period of time, investors may obtain better rents or larger profits once the property is sold to the market.

Before the advent of real estate crowdfunding platforms on the internet, crowdfunding required that an investor have access to a network of trustworthy partners and a profitable deal they can buy shares of.

As such, meeting interested parties with limited connections can be challenging.

Thankfully, real estate crowdfunding has enabled average investors to raise money for big projects easily by connecting them with like-minded individuals who share similar goals.

Real estate crowdfunding has also made property investments more accessible by providing investors a wealth of information about each project for informed decision-making while gaining access to an income-generating asset.

Lower investment minimums also level the playing field, allowing more people to participate.

Another key benefit of crowdfunding is the ability to diversify your portfolio with long-distance real estate investing: you can invest in multiple properties at once at different geographical regions where demand is growing!

This can lead to a great opportunity for passive income through real estate investing.

How to Invest in Crowdfunded Real Estate

Upon approval of your investment, it is usually marketed through a pool of investors via an investment page.

This page provides an overview of the project, including a financial summary with business plan details, sponsor descriptions and the status of the local market, a review of fees, legal structures, as well as potential future cash flows.

After reviewing the offering materials, the investor may push through with the actual investment transaction:

- Choose the investment you’re interested in and e-sign the legal document.

- The funds will then debited from your bank account.

- Your investment funds will be combined with the funds of other investors.

- When enough money is collected, the investment will be closed.

- As outlined in the offering materials, you will begin receiving distribution payments (if the investment performs as expected).

As with all investments, returns are not always guaranteed. Investments of the real estate sort may underperform for a variety of reasons such as when a sponsor is unsuccessful with following their business plan or if they have mistimed the current market.

In these cases, real estate investors may lose all or a portion of their invested capital.

Always pay close attention to your investment’s risk profile and make sure to align it with your goals. A word for the wise: never invest an amount that you are not prepared to lose.

There are a few things you need to know about real estate investing that determines the quality of the opportunity:

- Cap rate and cash yield

- Internal rate of return (IRR)

- Payback period (in number of years)

- Multiple on invested capital (MOIC)

I created a free rental property Excel spreadsheet that will help you invest in real estate smarter. Not harder.

You can download the calculator by clicking the button below. It only takes 5 seconds to download and get started.

You can use it to evaluate real estate crowdfunding opportunities as well as your own direct real estate investments.

How to Choose the Best Real Estate Crowdfunding Platform

When choosing the best platform, it’s essential to weigh both its benefits and risks. There are plenty of pros and cons of real estate investing relative to alternative options.

The most important part is that you weigh your options accordingly to find something that fits within your personal financial goals.

See how these stack up before deciding to shell out money.

Here are some practical tips:

-

Study the Risks

There are risks associated with every investment especially alternative investments like crowdfunded real estate. While investing is a great way to diversify your holdings, you must also consider diversifying your risk.

Let's hear from an expert on this part.

I've asked Professor John McConnell of Purdue University a few questions on the investment risks associated with real estate investing.

Professor McConnel has published more than 100 articles in leading peer-reviewed finance, economics and management journals including the Journal of Finance, the Journal of Financial Economics, and many others.

Professor John McConnell, Ph.D.

Burton D. Morgan Distinguished Chair of Private Enterprise (Finance)

What risks should investors consider for development projects versus in-construction projects?

From a financing perspective, a key question is whether the upside potential is sufficient to compensate for the possibility of the project not being completed.

What should minority interest investors know about investing in real estate, particularly when there are hundreds of investors involved?

This is a critical question for the minority investors in any project. The investor must have faith in the board of directors or shareholder representatives. Is there and auditor? Who chooses the board of directors?

How should retail investors think about equity cost of capital in real estate investing across markets?

Real estate values have been rocketing upwards in unexpected places, for example, Sun Valley which heretofore has been a playground, but with working away from the office becoming the norm, distant locations have become the norm. So - - diversification is always important.

See how your potential returns weigh against your projected risk to determine if equity investments or debt investments are better for you.

-

Be Meticulous

Before taking the plunge, know that each platform is different – some may fit your goals better than others. Practice informed decision making by identifying each platform's strengths and weaknesses.

Pay very close attention to the length of operation, track record, return performance, number of deals, management credentials, and company funding. You should consider doing your own underwriting of the underlying transaction.

-

Be Partial Towards Vetted Deals

A platform that vets investments is better than one that does not. There are crowdfunding sites that go through great lengths in protecting their investors by underwriting, evaluating, and structuring their investments.

Other websites, on the other hand, only work as a matchmaker.

Would you rather investigate and analyze a sponsor’s business plan on your own, or would you prefer having a corporate underwriting team guide you?

If you haven't done an analysis before, here's a thorough guide on how to underwrite real estate investments.

In addition, here is a real estate due diligence checklist to ensure you are covering all your bases for investing.

-

Look Out for Sites Partnered With a Registered Broker-Dealer

Sites partnered with registered broker-dealers are more official – they have eyes doing due diligence on every transaction, making sure that marketing materials are balanced and fair.

Try honing in on these websites whenever possible.

-

Make Sure Interests Are Aligned

When sponsors put in financial equity into a deal, they are more likely on pushing through with their business plans.

It is for this reason that some platforms structure their investments so that sponsors shell out money alongside their investors.

In the same way, some platforms also negotiate a “promote” interest, where sponsors receive higher returns only when their investors have been issued a base amount.

-

Review Your Investments

Yes, platforms make investments easier by offering a wealth of information about each property but know full well that these platforms are not investment advisors.

While some companies vet deals before making an offer to investors, not all companies do.

Consider it a good measure to consult with a fiduciary or a financial advisor who can help point out red flags or roadblocks. Good thing is you won't have to go through the headache of selling a property at a loss.

-

Consider Liquidity

In real estate, timing is everything. Properties have varying liquidity schedules, and there are unique return profiles for every investment.

Know full well how long you’re going to be locked into a deal when making your investment decisions. These are some other highly liquid investments to consider.

See Related: Top Real Estate Investing Terms

9 Best Real Estate Crowdfunding Websites

These are some of the top real estate crowdfunding sites to consider to help you make passive income through real estate investing.

-

Fundrise

If you’re just getting into real estate investing, Fundrise is a great starter platform. This tech-focused real estate crowdfunding for non-accredited investors offers access to real estate investments via eFunds and eREITs, or diversified portfolios of private real estate assets in the United States.

As opposed to other crowdfunding platforms, Fundrise welcomes investors across all 50 states.

Here’s the platform’s main draw: to invest in real estate, all you need is $500 to craft your starter portfolio. After shelling out a certain amount, the platform invests your cash in a plethora of residential and commercial properties in the USA.

Fundrise offers investments for property types such as commercial developments, rent-stabilized apartments, apartment renovation, and development, as well as home construction.

As of March 22, 2019, the Fundrise Starter Portfolio has reached an annual dividend of 6.55%. You may begin investing in more advanced plans on areas such as Washington D.C. or Los Angeles once your account balance tops $1,000. Doing this allows you to earn an annual dividend yield as high as 12%.

The good news? Compared to publicly-traded REITs, you won't experience the daily stock price fluctuations. In addition, Fundrise has an app you can use so you can invest on the go.

It's one of the many reasons why we named it one of the best real estate investing apps.

| Min To Invest | Accredited Only? | Fees | Next Steps | |

|---|---|---|---|---|

| $500 | No | 1%/year | Sign Up | Read Full Review |

-

RealtyMogul

As one of the first players in the real estate crowdfunding market, RealtyMogul has built an impressive track record that makes it one of the best platforms available today.

The company offers investments in a variety of categories, including retail spaces, multi-family condo buildings, and mobile homes.

The minimum investment is also attractive at $1,000 on a majority of offerings.

RealtyMogul is a platform for both non-accredited and accredited investors. Both can invest in RealtyMogul’s REITs. These REITs focus more on debt investments that yield a fixed monthly dividend.

If you plan on investing for more than three years, MogulREIT II is a better option, as it offers more potential when properties appreciate over the years.

The only downside to this option is a smaller monthly dividend. Want to know more? Read more in our full RealtyMogul review.

| Min To Invest | Accredited Only? | Fees | Next Steps | |

|---|---|---|---|---|

| $1,000 | No | 0.50%/year | Sign Up | Read Full Review |

See Related: Fundrise vs RealtyMogul: What Platform is Best?

-

Crowdstreet

As opposed to other real estate crowdfunding platforms in the market, Crowdstreet only focuses on commercial real estate including multi-family condo buildings, retail, and office buildings. What used to be a platform for accredited investors opened up to non-accredited investors in August 2017.

With a minimum investment of $5,000, the platform offers direct access to institutional-quality commercial real estate (other platforms allow you to invest in commercial real estate but only through a managing company or a lender).

Crowdstreet comes with all the online tools you need to make informed decisions on your investments. It's easy to view all active offerings, projected returns, and similar documents. All you need to do to invest is e-sign a couple of documents and send your investment.

Crowdstreet currently has an acceptance rate of $5 for borrower applications. Read more about the platform in our Crowdstreet review.

| Min To Invest | Accredited Only? | Fees | Next Steps | |

|---|---|---|---|---|

| $1,000 | Yes | 1-1.75%/year | Sign Up | Read Full Review |

-

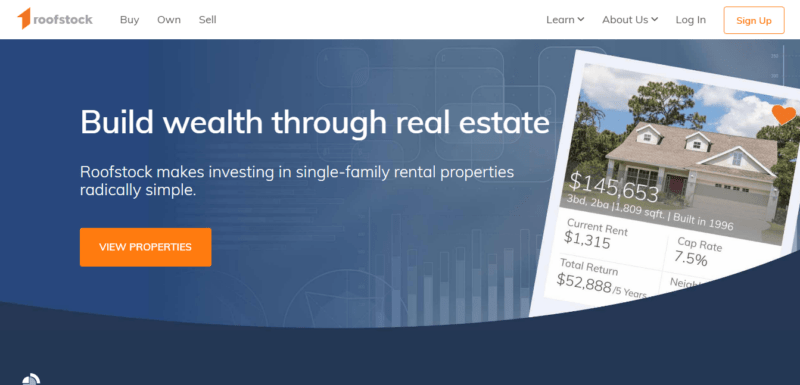

Roofstock

Roofstock prides itself on being the first online marketplace developed only for investing in single-family rental homes. It’s a relatively young company compared to others in the market, but the platform has already garnered over $1 billion in completed transactions.

Roofstock prides itself on being the first online marketplace developed only for investing in single-family rental homes. It’s a relatively young company compared to others in the market, but the platform has already garnered over $1 billion in completed transactions.

A platform created by investors for investors, Roofstock offers a wealth of information you need to evaluate and purchase properties including analytics, research, and insights.

All homes are vetted with attractive cash flow potential and investment profiles.

Roofstock’s ace is allowing investors to treat their real estate investments like stock portfolios.

This is done by focusing on asset allocation, as opposed to dealing with the stresses of property management.

See Related: Best Fundrise Alternatives

-

PeerStreet

PeerStreet’s main focus is debt investment loans. A platform made for accredited investors, PeerStreet allows you to invest in single-family projects such as storefronts and single-family projects.

From time to time, the platform also receives multi-family real estate and condo building projects as well. If you’re thinking about making short-term investments in various residential properties, PeerStreet is a platform to consider.

This real estate crowdfunding company collaborates with major lenders to generate funding. Transparency and great management are some of the hallmarks PeerStreet is known for.

PeerStreet charges attractive administrative fees as low as 0.25% for each investment (most crowdfunding companies charge 1%).

This makes the platform more accessible to the investor market. One more benefit of using PeerStreet is its automated investing feature that allows you to create investing screens.

Here, you may filter results via several factors including geographic region, property type, borrower, or loan maturity date.

The platform is open to all accredited investors with a minimum investment of $1,000.

You'll find loans with 6-9% returns and 6-36 month durations, making it a great choice for investors just starting in the real estate crowding space.

-

stREITwise

stREITwise is a popular real estate investment company that combines new federal regulations and innovative technology.

With a low investment minimum of $1,000 and low fees, stREITwise is revolutionizing the market and making real estate investing accessible to everyone.

Since its opening in 2017 in Los Angeles, the company has become popular among accredited and non-accredited investors. It has also delivered an annualized 10% dividend return to investors.

Want to learn more? Read about the platform in our Streitwise Review.

-

AlphaFlow

Interested in making multiple investments in several real estate offerings at the same time? Then AlphaFlow is a great platform to use. This crowdfunding platform allows you to make a single investment that is divided into multiple offerings on the website, much like a personal investor who assists you in making wise decisions.

AlphaFlow divides your contribution among 75-100 active investments – each of these investments is in residential properties with a 7.5% to 9% annual yield potential and a 6-12 month maturity date. This allows you to make bigger returns with a lower risk.

Your matured investments may be invested yet again, building up to a rising interest rate momentum.

While other platforms have a three to 5-year maturity date, you can withdraw your funds sooner in AlphaFlow penalty-free.

The only drawback is AlphaFlow's steep minimum initial investment of $10,000, but the diversified portfolio and maximized potential earnings more than makes up for it.

-

Rich Uncles

Launched in 2012, Rich Uncles is one of the oldest real estate crowdfunding companies in the market. The platform is open for non-accredited investors and focuses primarily on commercial property.

Just recently, the platform has also opened its doors to student housing as well.

The Student Housing REIT offers a 6% annualized dividend for student housing that has 90% rental accuracy rates, a 150-bed minimum capacity, and locations within one-mile walking distance of NCAA Division I campuses (at least 15,000 students must be enrolled).

This REIT just recently launched mid-2018, so the only available investment property so far is the Stadium View Suites, a complex located within the Iowa State Campus.

Commercial Property REITs are the platform’s premium options.

The company owns various retail and commercial properties across the United States, with store locations for companies such as Harley Davidson and Dollar General.

For higher investment incomes and to reduce the danger of missed payments and borrower default, the platform doles out a 50% down payment on each property. If you’re planning to invest, you must make a $500 initial investment.

Rich Uncles NNN REIT is currently available to residents of the following states: CA, CO, CT, FL, GA, HI, ID, IL, IN, KY, LA, MT, NH, NV, NY, SD, TX, UT, VT, WI, WY.

Meanwhile, the Student Housing REIT is available to investors in all 50 states, as well as all around the world.

See Related: 9 Best Rental Income Trackers

-

-

1031 Crowdfunding

-

With over 1.3 billion dollars raised and over $2 billion combined in real estate transactions, 1031 Crowdfunding is a force to be reckoned with in the real estate crowdfunding space.

With over 1.3 billion dollars raised and over $2 billion combined in real estate transactions, 1031 Crowdfunding is a force to be reckoned with in the real estate crowdfunding space.

Most of their offerings are commercially based, with a special focus on hotels, retails, and self-storage, but you'll find a wide array of multi-family homes as well.

The platform prides itself on vetted investments and over 60 years of combined experience in the real estate industry. Its main draw is a product called 1031 insurance.

This insurance sets them apart from other crowdfunding portals by guaranteeing that your exchange funds are invested in replacement property instead of being taxed for capital gains.

See Related: 70+ Ways to Make Extra Money

Summary- Top Crowdfunded Real Estate Site

This is our top pick for real estate crowdfunding depending on your goals. Each platform offers a differentiated strategy and approach. This app is the best way to gain access to a variety of investments for a low fee.

See Related: Best Alternatives to Fidelity Investments

Conclusion on Real Estate Crowdfunding

Real estate investing is one of my favorite ways to build wealth over time. You remain in control of your outcomes and can take a multi-pronged investment strategy approach.

It's a bit more hands-on, but that is where crowdfunding comes into play.

If you opt for crowdfunding, you'll likely lose some control of the outcome, but where it makes up is freedom and diversification.

Crowdfunding real estate gives you more freedom to invest passively and target certain investment types or geographies for added diversification.

My recommendations are the following:

- Fundrise – For investors with limited capital and beginners. Only a $500 limit to invest. Completely free to join.

- RealtyMogul – For non-accredited investors with more capital. Only $1,000 limit to invest.

- CrowdStreet – For accredited investors with significant experience investing in real estate.

Do you have any questions about real estate crowdfunding?

Contact me and I'll do my best to help answer your questions.